Roth Ira Rules 2024 Limits Over 50

Roth Ira Rules 2024 Limits Over 50. According to the fidelity ® q2 2023 retirement analysis, roth iras are. But other factors could limit how much you can contribute to your roth ira.

Whether you can contribute the full amount to a roth ira depends on your. In tax year 2023, you may contribute up to $6,500 to a roth ira, or $7,500 if you are 50 or older.

To Max Out Your Roth Ira Contribution In.

This figure is up from the 2023 limit of $6,500.

401 (K), 403 (B), 457 (B), And Their Roth Equivalents.

In 2024, the roth ira contribution limit is $7,000, or $8,000 if you’re 50 or older.

The Maximum Amount You Can Contribute To A Roth Ira For 2024 Is $7,000 (Up From $6,500 In 2023) If You're Younger Than Age 50.

Images References :

Source: rosaqselestina.pages.dev

Source: rosaqselestina.pages.dev

Tax Free Limit 2024 Farra Jeniece, The contribution limit shown within parentheses is relevant to individuals age 50 and older. The maximum roth ira contribution for 2022 is $7,000 if you’re age 50 or older, or.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS announced its Roth IRA limits for 2022 Personal, $6,500 ($7,500 if you're age 50 or older), or. This figure is up from the 2023 limit of $6,500.

Source: www.pinterest.co.uk

Source: www.pinterest.co.uk

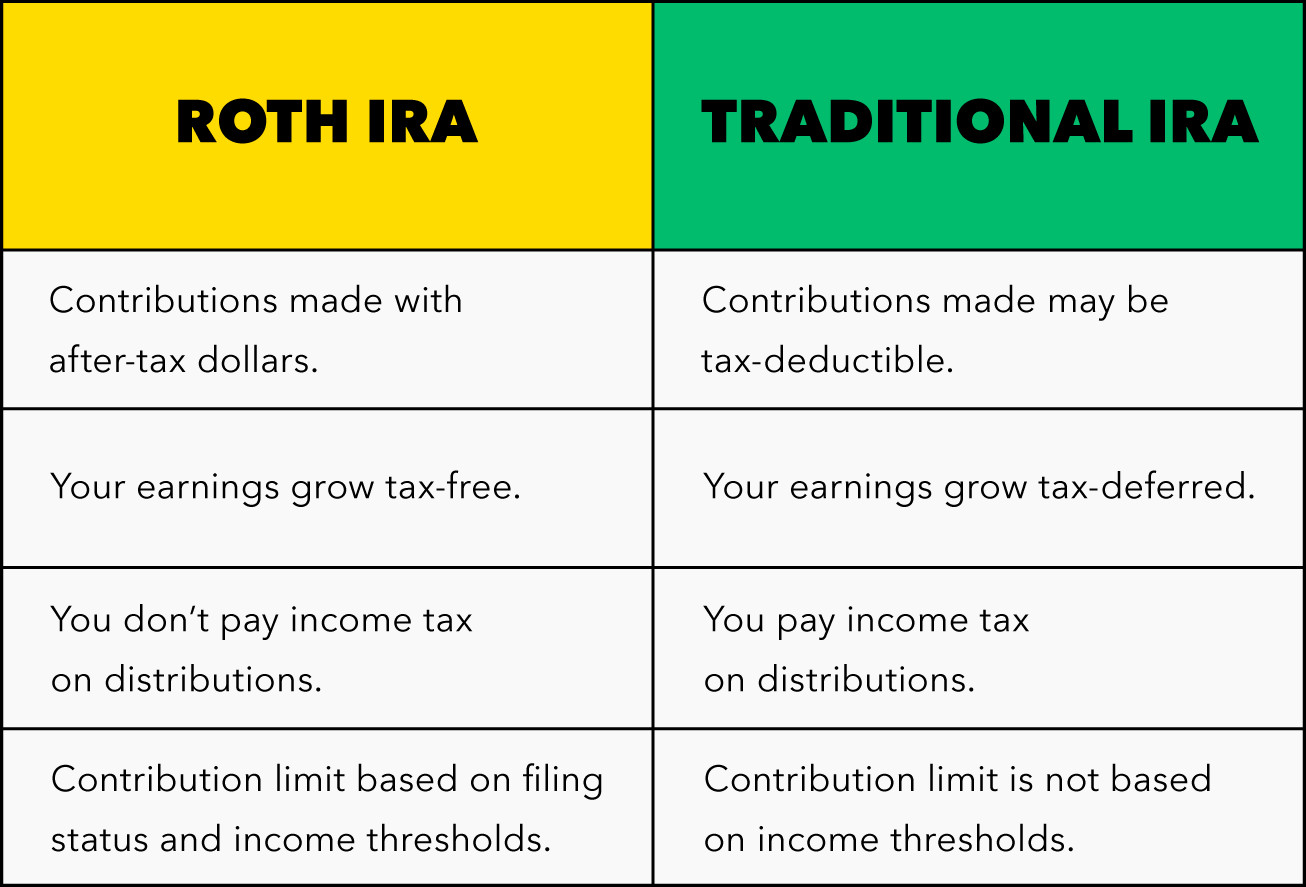

Roth IRA Rules What You Need to Know in 2019 Roth ira rules, Roth, The same combined contribution limit applies to all of your roth and traditional iras. The contribution limit shown within parentheses is relevant to individuals age 50 and older.

Source: maggiewmelba.pages.dev

Source: maggiewmelba.pages.dev

Roth 401k 2024 Limits Davine Merlina, 401 (k), 403 (b), 457 (b), and their roth equivalents. The same combined contribution limit applies to all of your roth and traditional iras.

Source: directedira.com

Source: directedira.com

Contribution Limits Increase for Tax Year 2024 For Traditional IRAs, For 2024, you can tuck away up to $7,000 in a roth ira if you are under 50. Your child's income must be below a certain threshold to contribute to a roth ira.

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, You can contribute up to 100% of your child's earned income to the roth ira, with. Earned income is the basis for contributions,.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Benefits Of A Backdoor Roth IRA Financial Samurai, Limits on roth ira contributions based on modified agi. If less, your taxable compensation for the year.

Source: mintapp.whotrades.com

Source: mintapp.whotrades.com

Roth IRA Early Withdrawals When to Withdraw + Potential Penalties, You can contribute up to 100% of your child's earned income to the roth ira, with. $6,500 ($7,500 if you're age 50 or older), or.

Source: www.carboncollective.co

Source: www.carboncollective.co

Roth IRA vs 401(k) A Side by Side Comparison, This figure is up from the 2023 limit of $6,500. Earned income is the basis for contributions,.

Source: inflationprotection.org

Source: inflationprotection.org

Important Changes to Roth IRA Rules and Limits in 2024 What, Investing in a roth ira means your money grows free from the irs's grasp, ensuring. 401 (k), 403 (b), 457 (b), and their roth equivalents.

But Other Factors Could Limit How Much You Can Contribute To Your Roth Ira.

The maximum you can contribute to a roth ira in 2023.

If You're Age 50 And Older, You.

The contribution limit shown within parentheses is relevant to individuals age 50 and older.