Roth 401k Contribution Limits 2025 Irs

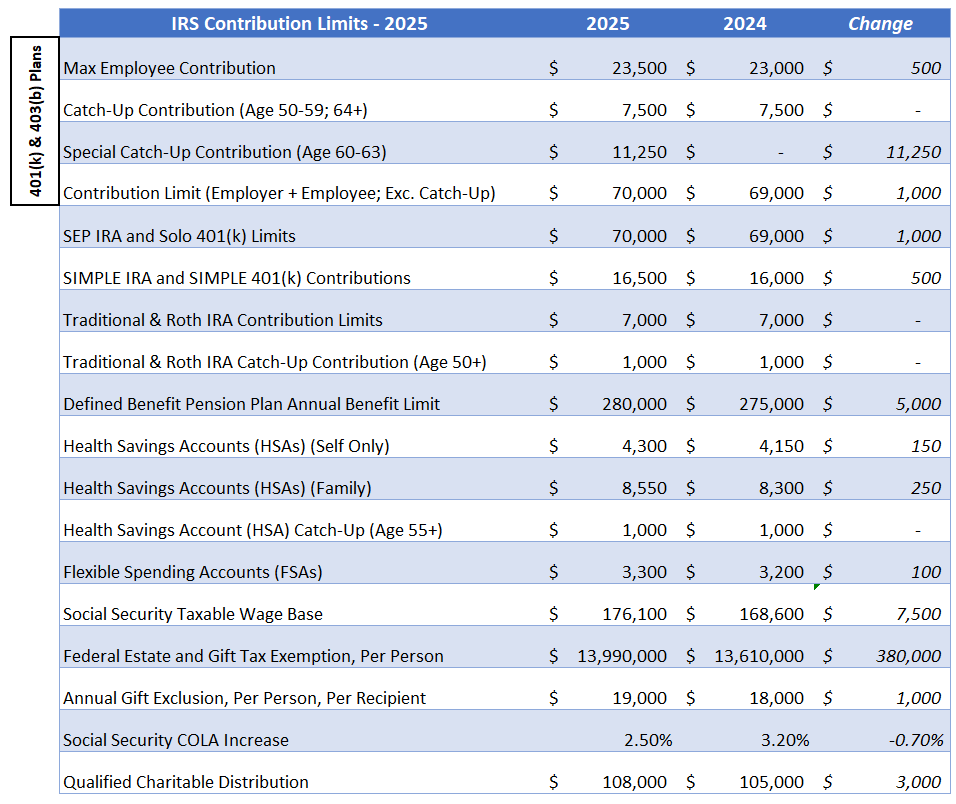

Roth 401k Contribution Limits 2025 Irs. Traditional and roth ira contribution limits. For the 2025 tax year, the irs is increasing the annual contribution limit for 401 (k) plans by $500 from the current limit of $23,000 in 2024 to $23,500 in 2025.

401(k) contribution limits for 2025 the 401(k) contribution limit for 2025 is $23,500 for employee salary deferrals, and $70,000 for the combined employee and employer. Discover limits, eligibility, and strategies for success.

Roth 401k Contribution Limits 2025 Irs Images References :

Source: kimberlyunderwood.pages.dev

Source: kimberlyunderwood.pages.dev

2025 Roth Ira Contribution Limits Married 2025 Kimberly Underwood, The 2025 roth ira contribution limits are the same as 2024, allowing you to contribute up to $7,000 or $8,000, based on your age.

Source: timforsyth.pages.dev

Source: timforsyth.pages.dev

2025 401k Limits And Matching Contributions Tim Forsyth, The secure 2.0 act included changes to traditional and roth individual retirement accounts and 401(k) plans that are being phased in over several years, some starting in 2025,.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, The 2025 roth ira contribution limits are the same as 2024, allowing you to contribute up to $7,000 or $8,000, based on your age.

Source: margaqdelores.pages.dev

Source: margaqdelores.pages.dev

401k Roth 2024 Contribution Limit Irs Rodi Vivian, Employee contribution limits go up $500 more in 2025, to $23,500 from $23,000.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

2024 IRS 401k IRA Contribution Limits Darrow Wealth Management, The roth 401(k) contribution limit for 2025 is $23,500 for employee contributions and $70,000 for employee and employer contributions combined.

Source: www.sensefinancial.com

Source: www.sensefinancial.com

Infographics IRS Announces Revised Contribution Limits for 401(k), 401(k) contribution limits for 2025 the 401(k) contribution limit for 2025 is $23,500 for employee salary deferrals, and $70,000 for the combined employee and employer.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Roth IRA Limits And Maximum Contribution For 2021 2025, In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit.

Source: johnwalker.pages.dev

Source: johnwalker.pages.dev

Roth 401k Contribution Limits 2025 John Walker, The 2025 catch‑up contribution limit for individuals aged 50 and over will stay at $1,000, the same rate from 2024.

Source: emmabell.pages.dev

Source: emmabell.pages.dev

What Is Max Roth Ira Contribution For 2025 Emma Bell, Maximum contribution limits for 401(k) plans are rising by $500 for many workers in 2025.

Source: adanbrosalind.pages.dev

Source: adanbrosalind.pages.dev

2025 Roth Contribution Limit Dionis Donelle, Employee 401(k) contribution limits for 2025.

Posted in 2025